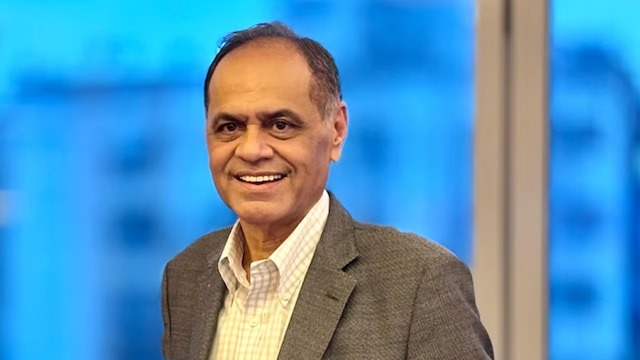

After the sell-off in October, the market has started November and Samvat 2081 auspiciously. On this occasion, during a special conversation with CNBC-Awaaz, veteran investor and member of Bombay Stock Exchange (BSE) Ramesh Damani mentioned two special themes on which he is very positive about the coming time. In this special conversation, he said that his outlook on digital infrastructure and pharma sector is positive.

Ramesh Damani said that he wants to focus on important themes like digital public infrastructure for the next 3-5 years. He also said that he is closely monitoring the changes in DPI and pharma sector.

India took a big leap in digital infrastructure

He said that he is especially focusing on two themes and it is not necessary that this focus should be from this Samvat to Samvat, but it can be for the next three to five years. These sectors are digital public infrastructure and pharma sector stocks. Referring to the reason behind this, he said that India has taken a big leap from analog to digital infrastructure. This journey is from highways to issuing PAN cards. Currently, there are about half a dozen companies, which are trading at reasonable valuation and market capitalization. This is not based only on the price-to-earnings ratio. But, their market capitalization is normal in terms of the opportunities coming ahead. He wants to invest in such companies.

Why a positive outlook on the pharma sector?

Regarding the pharma sector, Ramesh Damani said that some smallcap and midcap companies in this sector are developing in the field of intellectual property. These are intellectual properties like obesity vaccine, dengue vaccine, obesity pills, antibiotics and neuro-antibiotics. He believes that there are plenty of opportunities in this sector. For the first time, Indian pharma companies are working on such intellectual property. In such a situation, the market will start rewarding them in the coming time.

Ramesh Damani hopes that the government is going to increase expenditure soon, due to which recovery will also be seen in the stock market. He is somewhat worried about the slowdown in earnings, but this is only for some time.

Market closed with gains on the day of Muhurat trading

Meanwhile, on the first day of Indian Samvat 2081, the markets closed with a gain of about 1% on the day of Muhurat trading. In this way, the Indian stock market has made an auspicious start. On November 1, the day of Muhurat trading, the Sensex jumped 335 points and closed at 79,724. Nifty closed at 24,300 with a gain of 94 points after 1 hour of special trading on this day. Nifty Bank closed at 51,673 with a gain of 197 points. Nifty Midcap Index closed at 56,489 with a gain of 376 points.

Read More: बजाज फाइनेंस ने किया ट्रिपल सरप्राइज: बोनस, स्टॉक स्प्लिट और डिविडेंड का ऐलान, शेयर 5% टूटा"

Brijendra

Brijendra Share

Share